Bitcoin’s recent price decline is linked to the broader financial markets, showing a correlation with traditional assets on Aug. 1.

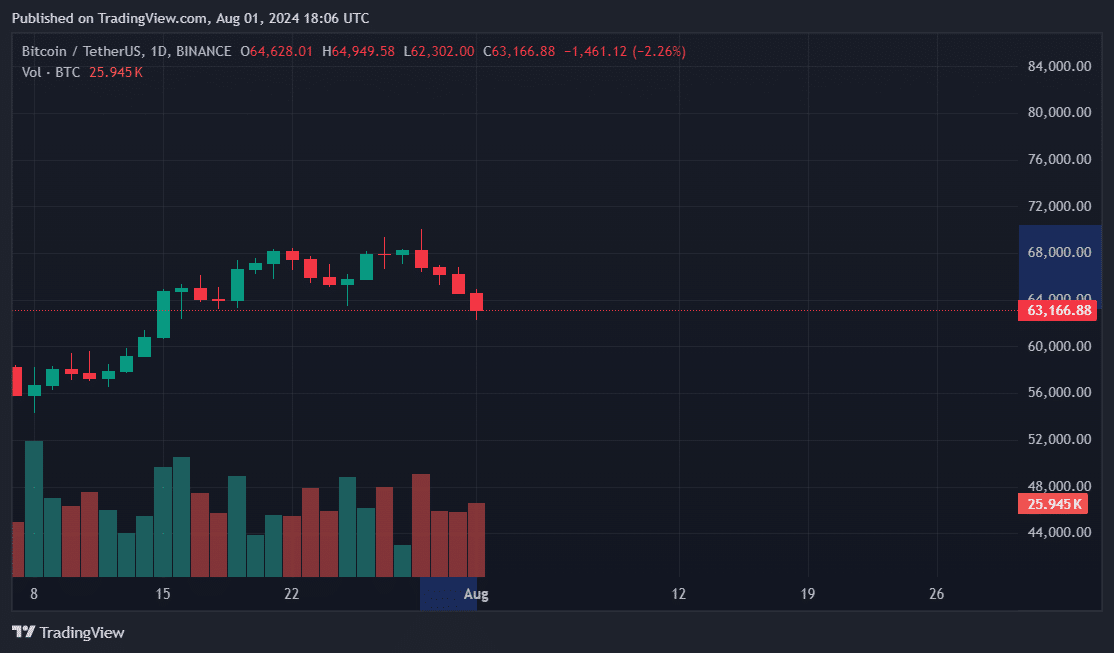

Since hitting a two-month high near $70,000 after remarks by former President Donald Trump, Bitcoin (BTC) has dropped over 10% to trade below $63,500 as of the latest data.

The simultaneous 7% drop in BTC’s value occurred alongside significant decreases in the S&P 500 and Dow Jones markets. The Dow Jones Industrial Average plummeted over 500 points within an hour, impacting major stocks like Amazon and Nvidia on Aug. 1.

This market volatility extended to the broader cryptocurrency ecosystem as well. CoinGecko data revealed a 6% decrease in the total crypto market cap to $2.3 trillion following earlier gains in the week.

The downturn affected other leading cryptocurrencies such as Ethereum (ETH), Solana (SOL), and Ripple (XRP), all entering a downtrend as investors retreated from digital assets amid the market turmoil.

Ether, Bitcoin lead crypto liquidations

Market volatility led to a significant number of margin liquidations, with over 105,480 traders affected and $324 million in leveraged positions wiped out according to CoinGlass data.

Ether saw the highest long liquidations at $72 million, followed closely by BTC at $69 million. SOL, XRP, and Dogecoin (DOGE) were among the most liquidated assets after Bitcoin and Ethereum.

Key Takeaway:

Bitcoin’s price decline parallelled traditional markets on Aug. 1, impacting the broader cryptocurrency ecosystem.